Understanding the EU’s CBAM: Reporting Requirements, Compliance Strategies, and ESG Impacts

With the implementation of the CBAM, companies importing goods into the European Union are facing a significant shift in the regulatory landscape. Designed as part of the EU’s Green Deal, CBAM aims to create a level playing field by pricing carbon emissions embedded in imported goods.

In practice, it means that businesses will need to track and report their carbon footprints meticulously, while managing the financial impact of carbon tariffs at the border. To help you better understand what this means for your business, we’ve outlined the key aspects of CBAM, the reporting requirements you need to prepare for, and the strategic steps you can take to align your operations with these new regulations.

What Is the CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is an EU policy designed to impose a carbon price on imports to the region. Essentially, it extends the EU’s existing carbon pricing rules to goods coming from outside its borders: If your products generate significant carbon emissions during production, you’ll face a carbon tariff when bringing them into the EU.

So why does this matter? The EU’s goal with CBAM is twofold.

First, it’s an effort to level the playing field for EU-based companies that already adhere to strict carbon regulations. Without CBAM, these businesses could be undercut by foreign competitors with less stringent environmental standards.

Second, CBAM is intended to encourage global decarbonization. By attaching a financial cost to carbon emissions, the EU hopes to drive sustainable practices beyond its borders, pushing global industries to invest in cleaner technologies and reduce their overall carbon footprint.

CBAM is not just an EU-centric regulation; it has global implications. Companies exporting goods to the EU must now consider the carbon footprint of their products, as these will be subject to the same carbon pricing as products produced within the EU. CBAM is designed to prevent "carbon leakage," where production might shift to countries with less stringent climate policies. This means that non-EU companies must align their carbon strategies with EU standards to maintain market access.

Benefits of CBAM

Anew Global, a member of the Inogen Alliance, offers CBAM reporting training to help businesses fully understand and prepare for the reality of this new reporting structure. With this insight, they have outlined the benefits of CBAM implementation.

These benefits include:

- Laying a foundation for compliance, helping companies prepare for mandatory CBAM requirements during the transition phase (Oct 2023 - Dec 2025).

- Linking carbon data to CBAM certificates, which allows for accurate emissions tracking and the potential to reduce carbon pricing costs.

- Supporting competitive supplier selection by enabling companies to provide emissions data, even if they don’t export directly to the EU.

- Encouraging factories to benchmark emissions, aiding early energy-saving initiatives and reducing potential carbon tax obligations.

Key Aspects of the CBAM Regulation

The CBAM regulation targets industries with high carbon footprints, focusing initially on sectors like cement, steel, aluminum, fertilizers, and electricity. These industries were chosen because they represent a significant share of global emissions, and they’re essential to many supply chains. Companies importing goods from these sectors into the EU should be prepared for the financial implications of this policy.

Timeline

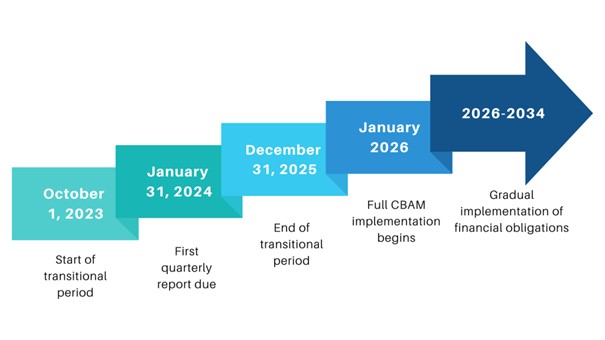

CBAM is being rolled out in phases, with 2024 marking a critical transition period. During this time, importers will be required to report the emissions embedded in their goods without facing actual financial adjustments. This phase is designed to allow businesses to get familiar with the reporting requirements and adjust their processes accordingly. From 2026 onwards, however, carbon tariffs come into full effect, requiring companies to pay based on their imported products’ carbon footprints.

Inogen Alliance member EnviroSolutions & Consulting (ESC) has created a detailed outline of the timeline:

Source: Carbon Border Adjustment Mechanism (CBAM) Explained for Businesses

Reporting requirements

CBAM hinges on accurate and transparent emissions reporting. Companies will need to track direct and indirect emissions from production and supply chains, ensuring that all relevant data is collected and verified. This means setting up systems to capture emissions data for each imported good, adhering to specific calculation methodologies outlined by the EU.

Accuracy is key; businesses that underestimate or misreport their emissions could face fines or increased scrutiny from regulators. Preparing robust data collection and verification processes now will be crucial to ensuring compliance once the financial implications come into play.

Preparing for CBAM Reporting: Best Practices

To navigate the upcoming CBAM requirements successfully, businesses need a proactive approach to managing data, assessing risks, and embracing digital solutions. Here are some best practices to help your organization prepare.

Establish accurate data collection systems

A cornerstone of CBAM compliance is having precise and reliable emissions data. Start by setting up or enhancing your existing data tracking systems to ensure comprehensive monitoring of carbon emissions throughout your supply chain. This involves gathering emissions data not from your direct operations as well as from third-party suppliers and partners.

Establish clear protocols for data collection, verification, and storage, with dedicated teams or automated systems to handle these processes. It’s crucial to stay aligned with EU-approved methodologies for calculating emissions, as discrepancies can lead to compliance issues or financial penalties.

Conduct comprehensive risk assessments

With CBAM set to add financial costs to imports based on their carbon footprint, understanding where potential risks lie is vital. Conduct a detailed risk assessment to identify which parts of your supply chain are the most carbon-intensive and where your business could face significant cost increases.

This analysis should also consider market volatility and price fluctuations in carbon credits, as these could directly affect your operational expenses. Assessing these risks early will allow you to develop cost mitigation strategies, renegotiate contracts with suppliers if necessary, or explore alternative sourcing options that are more carbon-efficient.

Implement technology solutions for compliance

Digital solutions can streamline CBAM compliance by automating data collection, calculating emissions, and generating compliance reports. Look into platforms designed specifically for environmental reporting, such as carbon management software or enterprise resource planning (ERP) systems with integrated sustainability modules.

These tools can help centralize your emissions data, reduce manual input errors, and provide real-time insights into your carbon footprint. Advanced analytics and AI-driven forecasting can offer predictive insights, helping you anticipate the impact of future regulatory changes and adapt your strategies accordingly. Investing in the right technology now can save you time, reduce errors, and keep your business ahead of compliance demands.

Final Takeaways: Staying Ahead of CBAM Regulations

The introduction of the Carbon Border Adjustment Mechanism signals a major shift in how the EU is addressing global carbon emissions, and the stakes are high for companies importing goods into the region.

The time to act is now.

Waiting until the last minute to prepare for these new requirements could not only result in compliance issues but also lead to financial penalties and strained supplier relationships. Taking proactive steps today — building reliable data systems, assessing risks, and leveraging the right technology — you can stay ahead of these regulations and turn compliance into a strategic advantage for your business.

Start Preparing Now

Now is the best time to prepare for the future financial impact of CBAM. Begin by reviewing your current emissions tracking and reporting processes to identify any gaps or areas for improvement. Consider engaging with sustainability experts who can help you refine your strategies, align your operations with CBAM requirements, and explore ways to lower your carbon footprint throughout your supply chain.

For more on upcoming EU regulations to watch, check out our blog here including the Drinking Water Directive, Biodiversity Strategy 2030 and Packaging Reduction Regulation.

Thanks to our Global Sustainability Working Group for expertise and inputs on this topic and teams at ESC and Anew Global Consulting.

If you’re looking for more detailed insights on navigating these changes, explore our additional resources on global sustainability reporting.

Inogen Alliance is a global network made up of dozens of independent local businesses and over 6,000 consultants around the world who can help make your project a success. Our Associates collaborate closely to serve multinational corporations, government agencies, and nonprofit organizations, and we share knowledge and industry experience to provide the highest quality service to our clients. If you want to learn more about how you can work with Inogen Alliance, you can explore our Associates or Contact Us. Watch for more News & Blog updates here and follow us on LinkedIn.