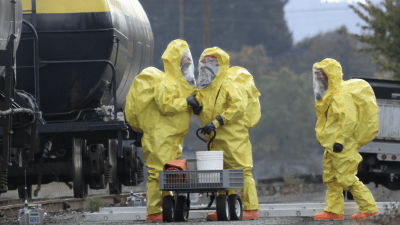

Inogen Alliance delivers efficient and consistent environmental, health and safety, (EHS) and environmental, social and governance (ESG) due diligence services that facilitate informed business decisions around mergers, acquisitions (M&A), divestitures, property development and sustainable finance investments. Our clients include Corporate M&A, Sovereign/Investment Funds, Private Equity, and Global Real Estate and Asset Management Firms. We help clients to avoid uncertainty and surprises by identifying, assessing and prioritizing EHS and ESG risks, allowing for efficient monitoring and control measures to prevent potential negative impacts to the business as well as capitalize on potential upside opportunities.

Although financial returns remain the key driver for investors, ESG has become a key part of investment decisions including climate risk, supply chain, social and human rights topics. We advise investors on ESG strategies with wider benefits that can be realized over the lifetime of the investment with a view to providing more significant increases in asset value. To demonstrate this, we can also provide return on investment (ROI) evaluations and monetize ESG risks and investments.

Where significant uncertainties exist, we offer financial and risk modeling to help build a comfort level that risks can be managed and incorporated into the deal. Our post-transaction diligence process allow you to strategize onboarding, integration and business continuity considerations with asset and operational business integration.

Have a question or need consultation in regards to EHS Due Diligence – International Mergers and Acquisitions? Contact a consultant below.

Minimise Risk and Strengthen Responsible Business Practices Worldwide

At Inogen Alliance, we enable enterprises to navigate their international merger and acquisition transactions seamlessly and effectively using local expertise through our global connections. With rising regulatory pressures and demand from stakeholders, let us help you turn uncertainty into opportunity and ensure your investments align with both financial goals and sustainability commitments.

Environmental, Health and Safety, Prioritized.

Learn more about EHS Due Diligence – International Mergers and Acquisitions through Inogen Alliance.

EHS and ESG Due Diligence Services include:

- Phase I Environmental Site Assessments

- Material EHS Compliance Reviews

- Comprehensive liability assessments and deal advising

- EHS advisory support with insurance underwriters and legal (deal negotiations)

- PFAS risk evaluations

- Decommissioning and site closure support for divestitures or post-acquisition restructuring

- Pre-transaction site characterization (Phase II site investigations) to close areas of uncertainty

- Geologic and geotechnical surveys for future site development considerations

- Climate change and risk assessment

- Carbon and transitions

- Transactional ESG screening and benchmarking – ESG risk identification

- Perform gap assessments, site inspections, record-keeping, and reporting

- Analysis of acquired subsurface liabilities and regulatory path-to-closure support

- Assessment against local and international regulations and standards, for eg. the United Nations Sustainability Development Goals (SDGs), International Finance Corporation (IFC) performance standards, EU Sustainable Financial Disclosure Regulation.

- Preparation of corrective action plans and/or environmental social action plan (ESAP)

- Post Transaction Support

- Permitting, waste management, Environmental Management Systems (EMS), etc.

- Corrective Action - Tracking and Closure of issues identified during due diligence

- Develop and implement site-specific procedures for EHS

- Develop and provide employee training

Key results:

- Successful incorporation of EHS and ESG related risks, liabilities, and opportunities into deal financial modeling for international acquisitions and mergers

- Successful characterization and management of EHS risks and liabilities for asset and operational divestitures

- Successful onboarding and integration of new assets and operations into your business

Corporate Mergers and Acquisitions

Expert risk management processes are a fundamental element of any corporate Mergers and Acquisitions strategy. Grounded in technical expertise and delivered in transparent language, our Associates provide solutions whether you seek to develop a comprehensive understanding of EHS and ESG liabilities attached to an acquisition, or are looking to supply buyers with credible information in order to maximize the value of an asset sale or capital restructuring.

Sovereign/Investment Funds

Beyond the traditional EHS due diligence, Government-run investment funds are increasingly focusing their due diligence investment efforts on helping the fund advance their stated ESG goals. Whether it's One Planet Sovereign Wealth Funds (OPSWF) three-principled framework, United Nations Sustainable Development Goals (SDGs), or other frameworks, we are well prepared to deliver value-added services.

Private Equity

Our experienced team at Inogen Alliance recognize the fast-paced pressures and demands of private equity M&A transactions and sustainable finance investments. Success relies on quickly grasping the complex deal dynamics, assessing EHS and ESG liabilities, focusing on material risks and offering pragmatic solutions to ensure a smoother and more confident decision-making process to close the deal.

Global International Real Estate and Asset Management Firms

The scope of Environmental Due Diligence is broadening. Although the assessment of contaminated land liability remains a core focus for real estate due diligence, the scope is broadening. Businesses investing in real estate are seeking to maximize the performance of their investments and increase their returns. Issues including Flood Risk and Climate Change Risk, Air Quality, Biodiversity, ESG, Planning, Ground conditions (including Foundations and Liquefaction) and Energy & Carbon also need to be considered. These factors not only need to be considered at the time of the transaction, but also during the lifetime of the investment, in order to maximize returns

Every transaction is an independent journey, and we, therefore, offer a range of approaches to meet client requirements, ranging from high-level traffic light assessments to comprehensive detailed reporting. With over 200 offices located on every continent, we have the capability and global reach to mobilize resources to support any deal, anywhere in the world with a local perspective.

Our international team of experts includes environmental professionals specializing in areas such as Environmental Permitting, Environmental Compliance, Health & Safety, Sustainability, ESG, Subsurface Characterization, Energy Management, Air Quality, Waste Management, Climate Risk and EHS Management Systems.

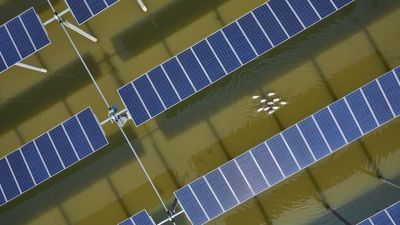

Environmental & Social Due Diligence for Solar Farm Portfolios

Inogen Alliance partner ESC was engaged as a consultant and advisor to conduct comprehensive ESDD studies. The process involved assessing local partners' operations, management systems, and compliance with local regulations, as well as international standards like the IFC Performance Standards and SFDR/DNSF. ESC focused on critical areas such as biodiversity and land acquisition management while reconciling risks across various solar PV platforms. They developed an Environmental and Social Action Plan (ESAP) to address identified gaps.

ESC's strategic approach was instrumental in identifying corporate-level gaps in environmental and social activities. By selectively reviewing high-risk projects, the Client could efficiently implement corporate E&S procedures. This enabled the fund to quickly identify and address critical gaps, facilitating the progression of the investment deal and supporting the broader energy transition in the region.